SBA 1531 2021-2026 free printable template

Show details

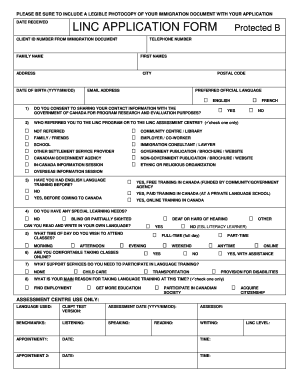

This form SBA Form 1531 should be completed by a small business concern seeking a COC determination from SBA that it is responsible to perform the specific contract. Are special skills required SBA Form 1531 05-08 Previous Editions Obsolete Yes No Total Manhours per week Are Employees with necessary skills FACILITIES AND EQUIPMENT Facility Area in sq. Control No* 3245-0225 Exp* Date 5/31/2011 SMALL BUSINESS ADMINISTRATION APPLICATION FOR CERTIFICATE OF COMPETENCY COC Case Number Instructions...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign certificate competency form fillable

Edit your sba certificate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sba 1531 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing stimulus check template pdf online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit stimulus application form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SBA 1531 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out apply for stimulus check form

How to fill out SBA 1531

01

Obtain the SBA Form 1531 from the SBA website or your local SBA office.

02

Begin with Part A - General Information: Fill in your business name, address, and contact details.

03

Move to Part B - Business Ownership: Provide information about the owners, including their percentage of ownership and contributions.

04

Proceed to Part C - Business Financial Information: Enter your business's financial data, including assets, liabilities, and income.

05

Complete Part D - Certification: Read the certification statement carefully and sign to confirm that the information is accurate.

06

Review all sections to ensure completeness and accuracy.

07

Submit the completed form to your local SBA office or the appropriate authority.

Who needs SBA 1531?

01

SBA Form 1531 is required for small businesses applying for an SBA loan that want to provide detailed business financial information and ownership structure.

Fill

certificate competency application

: Try Risk Free

People Also Ask about stimulus check form

How to get stimulus check 2022 without filing taxes?

Even if you don't owe taxes or have no income, you can still get this full tax credit. Fill out the IRS Non-filer tool to get the advance CTC or missed stimulus checks if you are don't need to file a 2020 tax return.

What form do I need to fill out to get my stimulus checks?

You can include additional changes to your originally filed return on the “Stimulus Payment” Form 1040X.

Can I apply for my stimulus?

If you didn't receive the most recent stimulus payment, you can claim it when you file your 2021 tax return.

How do I get a stimulus check 2022?

You will need to file a 2020 tax return to get the first and second stimulus checks and a 2021 tax return to get the third stimulus check. To claim your first, second, or third stimulus checks, wait until the 2023 tax season begins to get help filing your 2020 or 2021 tax return.

Do I have to file a form to get my stimulus check?

You will need to file a tax return for Tax Year 2020 (which you file in 2021). The deadline to file your taxes this year was May 17, 2021. The tax filing extension deadline is October 15, 2021. If you missed the filing deadline, you can still file your tax return to get your first and second stimulus checks.

What form is the 6475?

A: The Letter 6475 confirms the total amount of the third stimulus check (Economic Impact Payment) and any plus-up payments you received for tax year 2021. If you received joint payments with your spouse, the letters show the total amount of payment.

Do I have to fill out an application for stimulus check?

Some people will get their check automatically. Others will have to register with the IRS. Eligible adults, who have not yet registered or received their stimulus payment, must register with the IRS by October 15, 2020 in order to get their payment this year.

How do I claim the new stimulus check?

You will need to file a tax return for Tax Year 2020 (which you file in 2021). The deadline to file your taxes was last October 15, 2021. If you missed the October 2021 filing deadline, you can still file your tax return to get your first and second stimulus checks.

What happens if you didn't get a letter 6475?

What if I never received Letter 6475 or lost it? If you never received a third stimulus check, the IRS didn't send you Letter 6475. If you were eligible and didn't get a payment in 2021, you can get those funds now by claiming the recovery rebate tax credit on your 2021 tax return.

Are we getting a stimulus check in July 2022?

State leaders say an estimated 23 million people qualify for the checks, which will be sent out between October 2022 and January 2023. The payment is only available to residents who have lived in California for at least 6 months in the 2020 tax year or who are living in the state by the time the check is issued.

Can I still get stimulus money?

Thankfully though, the IRS says that some eligible taxpayers may be able to get missed stimulus payments. Depending on your circumstances, you may still be able to file a 2021 tax return to find out if you're eligible to get your stimulus payment, the 2021 child tax credit, or the earned income tax credit.

How to find letter 6475?

A: If you did not receive your Letter 6475, you can check Your IRS Online Account to securely access your individual IRS account information. The amount of your third Economic Impact Payment is shown on the Tax Records tab/page under the section “Economic Impact Payment Information”.

Where do you put the stimulus check on 1040?

You report the final amount on Line 30 of your 2021 federal income tax return (Form 1040 or Form 1040-SR).

What form do I fill out for my stimulus check?

You can include additional changes to your originally filed return on the “Stimulus Payment” Form 1040X. However, the only information that will be used to figure your stimulus payment amount is the information on your original return and the qualifying income you reported on this Form 1040X.

Will we get a stimulus check in 2022?

"Taxpayers will not receive an additional stimulus payment with a 2023 tax refund because there were no Economic Impact Payments for 2022."

Who is getting stimulus money in 2022?

How much California residents received is based on their income, tax-filing status and household size. Single taxpayers who earn less than $75,000 a year and couples who file jointly and make less than $150,000 a year will receive $350 per taxpayer and another $350 if they have any dependents.

How do I claim a stimulus check?

You will need to file a 2020 tax return to get the first and second stimulus checks and a 2021 tax return to get the third stimulus check. To claim your first, second, or third stimulus checks, wait until the 2023 tax season begins to get help filing your 2020 or 2021 tax return.

What form is the stimulus payment on?

Enter the amount in your tax preparation software or in the Form 1040 Recovery Rebate Credit Worksheet to calculate your credit. Having this information will help individuals determine if they are eligible to claim the 2020 or 2021 Recovery Rebate Credit for missing stimulus payments.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in application for stimulus check?

With pdfFiller, the editing process is straightforward. Open your how to apply for the stimulus check in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I complete how to apply for stimulus check on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your certificate of competency sba by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

Can I edit blank stimulus check template on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as stimulus check template. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is SBA 1531?

SBA 1531 is a reporting form used to collect information about small business loans made through the Small Business Administration's (SBA) lending programs.

Who is required to file SBA 1531?

Lenders participating in SBA loan programs must file SBA 1531 to report on the loans they have made and the status of those loans.

How to fill out SBA 1531?

To fill out SBA 1531, lenders must provide details such as borrower information, loan amounts, disbursement dates, and current loan statuses, ensuring accuracy in reporting.

What is the purpose of SBA 1531?

The purpose of SBA 1531 is to provide the SBA with data on loan performance and to analyze the effectiveness of its lending programs.

What information must be reported on SBA 1531?

SBA 1531 requires reporting information such as borrower name, loan number, loan amount, disbursement date, payment status, and any defaults or delinquencies.

Fill out your SBA 1531 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Stimulus Check Apply is not the form you're looking for?Search for another form here.

Keywords relevant to fha adp code list

Related to stimulus application

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.